Owning a home is a universal aspiration, but with soaring interest rates, the dream seems increasingly out of reach for many. The burning questions on every prospective homeowner’s mind echo in uncertainty:

- Should you continue renting until interest rates drop?

- Is it wise to purchase now and refinance later?

- What about trading up to a new home while selling your current one?

These decisions are rarely made with just numbers on a spreadsheet. These decisions often arise during dinner conversations, serene evening strolls, or even moments of reflection in the shower. Emotions blend with logic, making the decision-making process complex.

But let’s dissect the logic side.

Are interest rates truly at alarming highs?

Comparing today’s mortgage rates to those of the past two decades, the difference is stark. Rates are nearly four times higher than they were in 2020. It’s enough to make anyone hesitate.

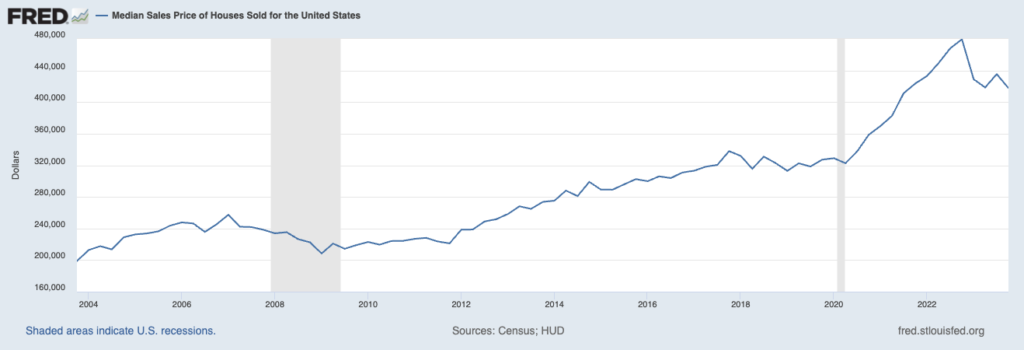

So, how do interest rates affect housing prices? Common sense might suggest an inverse relationship: higher rates, lower prices. However, federal data paints a different picture. Despite interest rate hikes, house values have consistently climbed over the long term.

The big question remains

Should you wait for interest rates to drop?

History tells us that real estate trends upward over time. But what’s ‘long term’? It varies. For those who bought around 2007, the breakeven point is roughly 7-8 years. But breaking even isn’t the only consideration when selling; there are additional costs like commissions and taxes.

One strategy emerges as promising: seizing the best of both worlds. Buy now at current prices with high-interest rates, then refinance when rates inevitably decrease. It’s a proactive approach to securing your dream home while optimizing financial benefits.

In the end, the decision to buy in a high-interest market isn’t solely about numbers—it’s about balancing Emotions with Logic. Are you ready to make your move?”